5 Pieces of Life Advice for New Grads

I’m an extremely nostalgic person and as I close in on turning thirty I can’t help but be sentimental and look back at my time of being an “adult”. I say “adult” because I really do still feel like a kid at heart. To me, being an adult largely started after graduating with my Computer Science degree at New York University in 2017.

Since graduating at the age of twenty-two, living in New York City, and starting my first full-time job as a software engineer, a lot has changed. I think back fondly at this time of my life but I still can’t help but think back and analyze the things that helped me get to where I am today and how large of an impact a few simple, conscious decisions have made in my life today. Today I wanted to share these five pieces of advice in the hope that they can help someone else.

Invest Early and Often

Start investing your money into vehicles that outpace the rate of inflation. This is incredibly important since time is one of the most important factors when it comes to investing due to compounding. Compounding is the process in which an asset's earnings, from either capital gains or interest, are reinvested to generate additional earnings over time. The longer your time horizon that longer and therefore the faster that your money can compound.

Because of this, it’s crucial to invest early and often. My recommendation is to automate this process and “pay yourself first”. Each time you receive a paycheck from work or elsewhere “pay yourself” a certain percentage by automatically transferring that amount to your brokerage account to use for investing. This will ensure that you’re constantly investing money into the market. Over time, with the power of compounding this sum can snowball into very large numbers. To truly understand this idea I strongly recommend that you do additional reading on your own after finishing the article including playing with a compound interest calculator to understand how big of a difference time and consistent investments can make in your life. There’s a reason Einstein said that “Compound interest is the eighth wonder of the world”.

If you need additional convincing here’s the notion that really woke me up — if you’re not investing your money you’re losing money. This is because of inflation, the rate of increase in prices over a given period of time. This means that idle money is slowly losing its value. Once I realize this I understood that my inaction wasn’t foregoing additional revenue but slowly losing existing revenue.

As a final note, while this isn’t financial advice I will tell you that I largely only invest in the S&P 500. It’s easy to chase large returns and get rich quick schemes, but I’d rather invest in something tried and true and sleep well at night not having to worry much about my investments. After all, Warren Buffett, one of the most successful American Investors suggests that most people should simply buy and hold the S&P 500 and I don’t believe I know better than him. Buffett also famously bet $1 million dollars that simply buying and holding an S&P 500 index fund would outperform money invested by a hedge fund. The hedge fund who took the bet conceded before the decade was even over.

Find Your “Why”

It’s easy to feel lost in your early twenties especially after coming out of college. It’s easy to doubt your decisions and especially yourself and your abilities. I definitely experienced these feelings when I was twenty-two. I doubted if I really wanted to be a software engineer, if I was actually good at coding, and constantly wondered if “this was it”, waking up, working from nine to five scraping by, and living for the weekends. Thankfully I don’t have any of these doubts anymore which is largely as a result finding my “why” and mapping out my goals.

Consciously deciding the things I wanted to chase after made a huge difference how I felt each day. It gave me a direction to constantly move in and a way to make decisions (i.e. does doing x move me closer or further from the things I care about). While we’ve talked about this concept a lot in past articles, (Taking no risks is the biggest risk of all, Build Your Passion, 4 Simple Steps to Actually Achieve Your Goals, Goal Setting) I can’t overstate its importance.

If you’re not sure what your motivation is, your “why”, or your goals are just yet, don’t panic that’s ok — take time to think about them. Write down the things you’re good at, the things you care about, and the things you enjoy. I think the concept of “ikigai”, a concept that encourages people to discover what truly matters to them and to live a life filled with purpose and joy, can be very helpful here.

Most importantly, explore and try things! Trying things will help you understand the things that you both like and dislike and the beauty is in either case each experience, good and bad, will help guide you closer and closer to finding what you really want to work hard at.

Once you’ve found your “why” and what you’re choosing to work hard at you can begin reverse engineering a plan to get there. This can be done by simply finding someone who is already where you want to be, and working backwards to understand each of the steps that they took to arrive at that destination. While there isn’t always a nicely plotted path, doing this exercise can be helpful in at least understanding common themes between getting from point A to point B as well as gauging how long it might take you to reach B.

My favorite part about this process is that life very much mirrors a good video game. Like any good game, you have a clear goal and you can spend time working towards it. In this way each day begins to have purpose and can serve as a stepping to help you get to where you want to be. And if you pick good goals and motivations, as you reach checkpoints towards your goals you unlock new rewards. If these new rewards don’t excite you you should question why you’re playing that game in the first place — maybe you’ve chosen the wrong goal.

Live Frugally

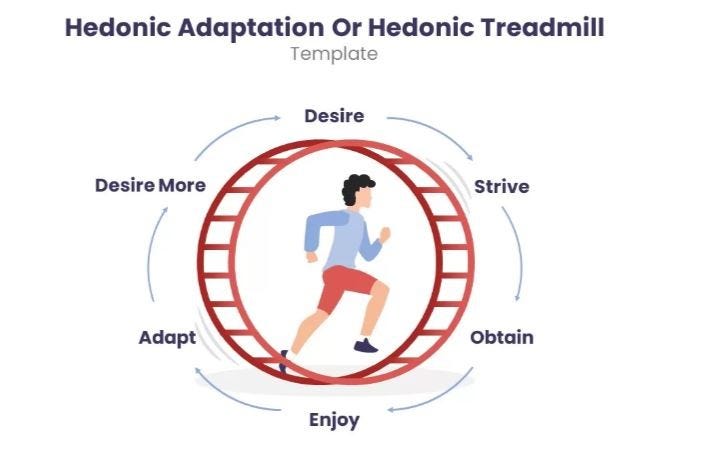

Choose to live frugally especially early on. Once you start making money it can be easy to get sucked into a pattern where you trade money for temporary hits of dopamine. After all, it feels good buying something new, but science tells us that we quickly return to our baseline level of happiness shortly after. This concept is known as the hedonic treadmill.

Living frugally will help you save and invest your money setting you up well for the future. And to be clear, I’m not suggesting you spend no money, but instead, that you find meaningful things that make you happy. I’ve found that many of the things that are meaningful to me are either free or don’t cost a ton. Watching an episode of TV after a long day, lifting weights, or going for a walk with a friend.

While it’s easy to spend lots it’s also easy to stress yourself out saving. Because of this, I strongly recommend setting a budget for yourself. This ensures that you put guardrails in place ahead of time which make decisions easily since you only need to ask one simple question — “does this purchase fit in my budget”. Since graduating, I’ve always budgeted and it’s helped me balance setting myself up well for the future while still enjoying the present.

I highly recommend Monarch (30 day extended free trial), the tool I use to track my net worth, my spending, and my saving. My favorite part is that because I’ve tracked my finances from the very beginning of my career journey, I can understand how my finances have changed over time and be proud of myself for just how far I’ve come.